G

Gold Focusing: News and Commentary on the present staging of value and its functioning delusion. Gold is EVERYONE'S Standard, and from that perspective I look at the twisting actions of the control group.

Thursday, December 15, 2011

They don't want you to have gold.

G

Wednesday, December 14, 2011

Gartman calls gold bull dead—BUT is it really?

- Market trading technicals have been severely tested across all financial instruments

-Marauding trader groups (hedge funds, investment banks, deep pockets of the world's ruling-owner elite) are pushing for capitulation in every corner seeking to unhinge and unseat what remains of independent and weaker investors and traders.

-Short attacks are common place with the dark pools doing much of the 'painting' and Miss&Dis-information distribution masters manipulating the markets and media. IMO

BUT after all is said and done today what has actually changed fundamentally with the picture:

1. The world's finances are an utter disaster

2. Fiat currency valuations are purely fear driven

3. Banks have been adding gold at fast rate

To underscore the point—here is the three year weekly chart for gold... notice anything?

I see no trend breakage do you? Maybe Gartman is a trader so his short hairs might be in the grasp of today's great market painters— =\

So IMO Dennis wrong period. Unless you want to trade this market. This is big mistake IMO. What do you think?

G

Death of Gold Bull Market Seen by Gartman

By Nicholas Larkin

Excerpts:

“Since the early autumn here in the Northern Hemisphere gold has failed to make a new high. . . . Each high has been progressively lower than the previous high, and now we’ve confirmation that the new interim low is lower than the previous low. We have the beginnings of a real bear market, and the death of a bull.”

believing that "...wholesale liquidation, and perhaps forced liquidation, shall be the outcome.”

Read the full article here

Wednesday, December 7, 2011

Why Does Jay Taylor see DEFLATION as GOOD for GOLD?

There are a number of intellectual gems in this article that warrant a little due diligence by us all, All the chatter about what will happen around money and gold has all centered on inflation as the loss of value.

Jay, in saying deflation will increase gold's value, adds to our understanding of what's going on. There is no real conflict with the prevailing view of gold being a protection against inflation.

The real view, implicit in gold's aura is that the problem is money itself—and its governance, hence trustworthiness, of the whole 'class of bankers' and there relation to their actual utility and true place in our emerging world.

Gold is EVERYONE'S Standard

G

'Deflation in US to create boom in junior gold stocks'—Jay Taylor

Jay Taylor believes the biggest challenge facing the U.S.—deflation—could mean a better year, or even decade, for junior Gold stocks. Taylor, editor of Jay Taylor's Gold, Energy & Tech Stocks, has ridden some equities to the bottom of this punishing market and is ready to pile more cash into small gold companies. In this exclusive interview he explains why market sentiment hasn't shaken his faith.

Companies Mentioned: American Bonanza Gold Corp. - Aurvista Gold Corp. - Calico Resources Corp. - Crocodile Gold Corp. - Great Panther Silver Ltd. - IAMGOLD Corporation - Meadow Bay Gold Corp. - Merrex Gold Inc. - Metanor Resources Inc. - Nautilus Minerals Inc. - Pretium Resources Inc. - Prodigy Gold Inc. - Rye Patch Gold Corp. - Sandstorm Gold Ltd. - Silver Wheaton Corp.

The Gold Report: In the Nov. 4 edition of Hotline, you note that America's ratio of debt to gross domestic product (GDP) is north of 350%. Our total debt as a society is somewhere around $57 trillion (T). That's worse than Greece. Is deflation America's biggest economic threat?

Jay Taylor: I believe it is, however, most of my goldbug friends wouldn't agree. It is important to realize that the U.S. is not a third-world country. It still has the world's reserve currency. The central bank, the Federal Reserve, doesn't put money into the hands of the masses. It puts money in banks. It's all about credit extension. That is very difficult to do now. With the debt-to-GDP ratio as it is, it's unsustainable. The markets are telling us that—not only in the U.S., but clearly in Europe as well. We are undergoing one of the largest debt-deleveraging periods in a long time, which may be much larger than what we went through in the 1930s.

TGR: You believe there should be no more bailouts, let this debt wrench itself out of the system and let bankruptcies occur.

JT: Absolutely. Most people don't understand the reason we're in trouble is because the good times that we had were false. They weren't based on savings and investment. They were based on money creation through credit extension. The nice homes, the big office buildings, fancy cars, everything—it wasn't earned, it was based on debt. Now that the debt cannot be repaid, the expansion goes into a contraction. That process has a long way to go.

Read more here

Extracted: Jay's list of junior gold stocks.

Friday, November 18, 2011

Gold Mining Stocks Looking Set to Rally

As an investor it is clear we are seeing continuing opportunity to accumulate gold stocks. Gaining the greatest leverage for the return of the uptrend in gold equities is, for me, to be found in junior gold stocks with assets—especially those ones still in the penny to two dollar range. See my recent picks in the 'Gold' tab above.

G

From Seeking Alpha

Expect Gold Mining Stocks To Rally

By Robert Hallberg

The gold mining business has been a tough industry for investors over the last couple of years, despite skyrocketing gold prices. Gold has outperformed most other asset classes but the mining shares have not kept up with gold’s performance.

There are many theories why the shares are lagging behind, some say that frightened investors prefer the safety of gold bullion, and others say that newly launched gold derivatives and ETFs has been competing with the shares for capital.

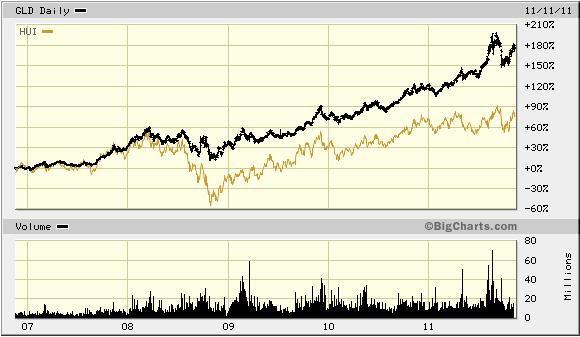

Until recently, many gold equities had been in a multiyear trading range with flat stock performance despite increasing revenues and substantially higher profits. The gold bugs index (HUI) is a good benchmark to see whether gold stocks in general are outperforming or underperforming gold. It is composed of the 16 largest and most widely held public gold production companies.

The chart below compares gold’s (GLD) performance against the HUI. Both gold and the HUI were neck-to-neck until the financial crisis of 2008, when gold pulled away. Until this day gold has been a far better investment than most gold stocks.

click to enlarge

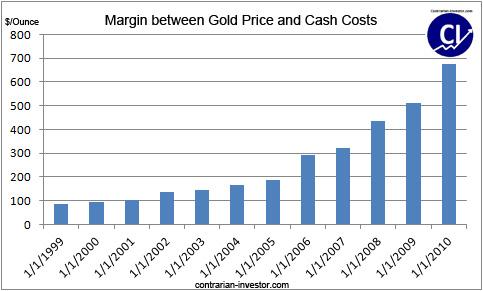

Although the shares have been lagging behind, there are a number of developments that suggest that the mining companies might be ready to catch up and outperform physical gold and silver. First, margins between the gold price and cash costs of production per ounce have been growing steadily. This has led to vastly increased profitability. The increase in margins has been a result of higher gold prices as production cost has been increasing at a much lower rate. This chart below shows the average industry margins between the gold price and cash costs of production per ounce.

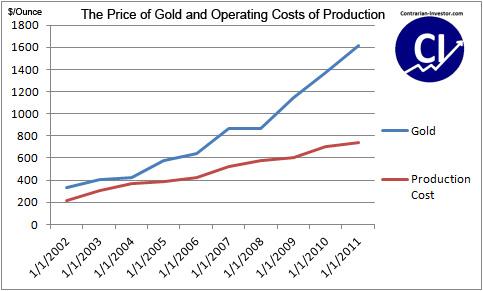

The next chart compares the price of gold and the operating costs of production. The price of gold has been increasing at a much higher rate than the production cost and as long as gold remains at present levels the gold mining companies will remain highly profitable.

Read full article here

Tuesday, November 15, 2011

Let's look at a couple of Gold Stocks: CBJ-V AND LAD-V

On the bottom edge of the juniors I have a two I am looking at today.

CB Gold (CBJ-V: TSX)

Excerpts from Stockwatch Business Reporter:

"Two weeks after revealing impressive assays from a drill hole at its Las Vetas gold property in Colombia, CB Gold Inc. has toned down the excitement with, as requested by the British Columbia Securities Commission, restated assays including a top cut. A top cut reduces (or cuts) an uncommonly rich assay, usually a short intersection, to a lower assay -- say from several hundred grams per tonne gold to 50 g/t -- and then the average of it and other assays is recalculated.

"In its earlier news release of Oct. 24, CB Gold reported a 114.98-metre interval of 7.57 g/t gold, including 2.09 metres of 316.67 g/t gold, but used no top cut in its calculation. There is no suggestion the company tried to conceal the narrow intersection of extraordinarily high gold."

"...With a 60 g/t top cut, CB Gold's 114.98-metre intersection drops to 2.54 g/t gold, and with a 15 g/t top cut, it falls to 1.2 g/t gold, as stated in the company's Nov. 8 press release. The company says it has not explored the property enough to define a mineral resource, and investors will have to wait for more drill results. "From their website: http://www.cbgoldinc.com

"The Vetas Gold Project is a combination of small producing mines and detailed exploration over adjacent areas. Although historically there have been a number of small underground mines producing gold near the village of Vetas, District of Santander, the project is at an early stage of development. Prior to CB Gold's acquisition of the properties, at least eleven small underground mines were in production, but no systematic underground exploration and development, or surface exploration, was carried out on the property by previous owners.

"CB Gold has acquired interest in nine mining titles, of which six are registered in the name of the Company. All nine properties host quartz veins containing high grade gold and have historical production. In total, the project covers a total area of more than 1,000 hectares in Northeastern Colombia"

So we know there is gold there. Question is: How much? For me the simple fact that there is a lot of historical activity and that the property has has no systematic exploration makes this one a definite watch and wait—wait for opportunities to accumulate. IMO this one would rise in value significantly if their next drill holes continue to produce higher grades. Ultimate value though will depend on the cost of production. You can find their Fact Sheet here.

New Carolin Gold Corp. (LAD-V: TSX)

Another company which owns a property with a history of gold mining. New Carolin Gold Corp. is a company who's share price makes it look like a long shot, until you look at its fact sheet (downloadable here). So I like it—I'm all about looking a couple of these potential multi-baggers!

New Carolin Gold Corp. is a new company with a historic gold mine on a known trend, the Coquihalla Gold Belt. The original Carolin Mine still has its sign on British Columbia's Coquihalla Highway and a road that leads into the mine property. Their Fact Sheet sums up their starting position for my numbers quite well and speaks volumes about the people behind this deal IMO.

Just looking at its recent NI 43 101 on the tailings from the original Carolin Mine gives it 29,000 ounces of gold which gives a share value of between .42 and .85. Historical drilling inside the mine shows the resource to be open at depth.

It is my belief that there is very little risk to the downside for shares of this company, in my opinion. Therefore this one for the watch list and in the interest of disclosure I have bought shares in this company.

As always do your own due diligence put them on your watch list and then review any buying decision it with a qualified professional before investing in either of these companies.

Trade well and prosper.

G

Why Gold Stocks Are So Cheap Right Now!

G

Gold Stocks Are Cheap – Dirt Cheap

By Alena Mikhan and Andrey Dashkov

Despite the pullback this fall, gold has been performing well this year. The price of the yellow metal is up 28% YTD, driven in large measure by strong demand in Asia and the dim economic outlook in the west. Gold miners are reporting good third-quarter bottom lines. In this ointment, however, there is a fly: gold stock performance, which has massively lagged the underlying commodity price surge over the year. This has been ongoing for months, now bringing us to the point where gold mining stocks look notably undervalued.

Technically, we might say, they look dirt cheap. Even Doug Casey, who's a serious bottom feeder, is admitting that compared to the metal itself, gold stocks are looking cheap again.

Consider these charts:

(Click on image to enlarge)

(Click on image to enlarge)

The average price/earnings ratio in the industry – a valuation ratio of a company's current share price compared to its per-share earnings (quarterly figures are used here) – is going down while the price of gold is increasing. This situation has persisted for several quarters; and now gold stocks look cheap on a P/E basis.

This big divergence between companies' earnings and the underlying commodity price won't last: Either gold will retreat or P/Es will catch up, or both. Since the fundamental trends driving gold upward are still very strong, the second scenario looks more probable, raising the prospect of a huge rally of mining stocks somewhere in the short- to mid-term. Comparing changes in the AMEX Gold Bugs Index against gold leads to a similar conclusion: in the second half of 2011, gold stocks have been lagging. See the chart below.

(Click on image to enlarge)

If they are on sale, why aren't we seeing a rush into these equities?

One opinion on why gold stocks are not recognized by the general investing public as being cheap is concealed in the way stocks are estimated. Most analysts prefer to use an unrealistically conservative gold price, which is far below what we have been observing for quite a while now. From Pierre Lassonde, in a Mineweb article: Read more here

Are Gold Stocks Set to Move Soon?

The Seeking Alpha article by Bruce Pile below attempts to do just that. Personally I am not trying to time the market but as I believe quite strongly that the opportunity is real I am already positioned and will look to add more as I am able and I plan to trade the up cycle once the trend change is confirmed.

G

Gold Stocks Are Ready to Reignite

by Bruce Pile

Investors seem to be fretting about a weakening recovery as the numbers continue to disappoint and stocks are showing signs of fizzling. And then there's the looming end of QE, a huge fuel source for money going into the stock market. So what's a gold fan to do regarding gold and silver stocks? There is a school of thought that says all "risk-on" speculation positions are vulnerable. And that includes miners of anything - even gold, and especially silver with its heavy industrial use. Gold stocks have been a dog lately, so is now the time to sell or buy?

Some instructive comparison can perhaps be drawn by looking at the last time we had an obvious slowing economy coming at us. This was over the last half of 2007. So how did gold and silver and the associated stocks behave in '07 as the weak economy started taking hold?

First, let's look at how well the discounting of the market was working during this period by looking at Dr. Copper, the commodity with the PhD in economics:

Here we see that the doctor was right in seeing the approaching recession coming as usual. The key 140/200 day ema (blue and red lines) broke out of its bull mode with collapsing divergence in November. So if you had the same angst about all economy sensitive commodities, you perhaps would have been a seller of silver at this time with its usage being primarily industrial. Gold during this period moved up sharply. So silver had a choice to either follow its monetary partner, gold, with a historical R squared correlation of something like 0.9, or to follow its economic partner, copper. Which did it do? Here is the silver chart for that period:

Read full article here

Friday, November 11, 2011

Gold Is Becoming the Sole Safe Haven

Unafraid to pointedly call out the creators of the world's financial mess—the leaders, banksters and their 'owners'—Max describes the monetary terror unfolding before our eyes its sources and the undeniable and sole safe haven of gold as the titans of our destruction dance the light fantastic on our economic futures.

G

Max Keiser and co-host, Stacy Herbert, discuss European gold wars and the brokers at the Chicago Board of Trade telling others to get a job while they can't even do the one job they have. In the second half of the show, Max Keiser interviews James G. Rickards about his new book - Currency Wars: The Making of the Next Global Crisis.

Tuesday, November 8, 2011

Falling Inflation Bullish for Gold?

G

Excerpt reposted from 24hGold

Whilst many may argue that gold is an inflation hedge and therefore inflation is bullish for gold, in reality the dynamics at play here are not that simple.

In our view, gold is a currency. Therefore fluctuations in its price are largely based on its perceived value relative to other currencies. We would not suggest that its role as an inflation hedge is a primary reason for being long gold, since there are far more direct and efficient ways to hedge against inflation risk in this modern financial environment. We do however see currency devaluation as a primary reason to own gold. If one thought the Yen was going to strengthen against the dollar, then one would move USD holdings into JPY. If one thought the Yen was going to weaken against sterling, then one move JPY holdings into GBP. This environment is unique as across the world governments and central banks are trying to lower the value of their currencies. Therefore there is nowhere to go, except for gold which cannot be printed in an attempt to erode its value.

The US Federal Reserve has a dual mandate to both maintain price stability and full employment. This means their job is to prevent deflation and keep inflation in a tolerable range, plus ensure that unemployment is not too high.

Clearly the employment side of this mandate is not being met at present, with the latest US payroll data showing unemployment still at 9%. However the one thing holding the Fed back from further easing is inflation. We can therefore deduce that a drop in inflation would be very bullish for gold prices, as it would increase market expectations of more large scale asset purchases (LSAPs) by the Federal Reserve.

Friday, November 4, 2011

Gold Stocks: The Buying Opportunity 1

G

excerpts:

"Gold stocks haven't rallied in line with the gold price in the last few months. In fact many gold equities have remained range bound despite the precious metal's break through to record levels," said Harmony Gold Mining (HAR) financial director Hannes Meyer. ...

Almost all gold companies, both local and international, have either reported or are expected to report a significant increase in profits in the three months to end September thanks to the run in the gold price. ...

"We believe that the gold price will continue to strengthen as the fundamentals that drove the gold price up are still in place," the company said in its September quarter results statement.

Read source here

Wednesday, October 26, 2011

More Currency Hurt Coming says Gartman—Get Real Money—BUY GOLD

G

Gartman: EU Debt Plan to Hurt Currencies - Buy Gold in USD, GBP and EUR as “Is a Currency”

Gold has edged higher in all major currencies again today as concerns about the European debt crisis and the risk of contagion is leading to demand for gold for wealth preservation purposes.

The likelihood of the Eurozone sorting out their intractable problems has come into question again as bankers in Europe’s largest banks have clashed with politicians about the size of losses they will have to take on their Greek debt.

Another bullish factor is more dovish sounds from the Federal Reserve regarding driving down mortgage rates to support the housing sector and another round of quantitative easing which was suggested by William Dudley, president of the New York Federal Reserve Bank.

Physical demand out of Asia remains robust as seen in healthy premiums with gold premiums in Vietnam gold at a $28.07 premium over world gold of $1,642.65 and Shanghai gold closed at a premium of $12.89 to world gold of $1,652.25 (see LeMetropolecafe.com for Asian premiums).

Diwali is tomorrow and Indian demand has fallen somewhat but remains robust despite very significant demand in recent days and weeks.

Newsletter writer Dennis Gartman has done a swift about turn and is now adding to his gold position by buying the metal priced in dollars, pounds and euros, he wrote today in his daily Gartman Letter.

Only last Tuesday, Gartman wrote that the gold market is suffering "very real damage." His comments were picked up very widely making headlines in the financial media internationally. Gartman warned that he feared that the rally from September's lows is "now under assault."

Today, Gartman said in his newsletter that he was certain gold prices would break upwards sooner rather than later.

Gartman said that the EU debt plan would hurt currencies. Therefore, gold will rally as currencies fall.

"The authorities have no choice but to inflate their way out of the morass that they’ve found themselves falling into and that shall mean the diminution of currencies generally and the advancement of gold as the only currency not diminished", he said.

"Gold is a currency; it has been for years and it shall be for years going forward. A move upward through EUR 1,200 for gold today or tomorrow or this week or next shall be impressive and important," he said in the newsletter.

...

Gold Majors are Starting to Act on Their Need for Gold Assets

The search for good Juniors has started!

My favorite is New Carolin Gold Corp. - a new old mine which closed soon after opening just after the 1982 peak in gold because they were too late to the party. Now t.hat is not the case—timing is everything. (PSSSST this is the time =])

Here is the news:

Iamgold investing $3.42M in Colombia Crest Gold

Iamgold Corp., a Toronto-based gold mining company, will pay $3.42 million for a nearly 20 percent stake in Colombia Crest Gold Corp.Hans Rasmussen, CEO of Colombia Crest Gold, said the investment by Iamgold underscores "the potential for a near-term exploration success once we drill the recently discovered Arabia porphyry target."

Read more here

AngloGold Ashanti CEO: Gold could "easily" hit $2,200 in 2 years

What I am looking for are indications that the majors are preparing to buy up some juniors and I do see in this CEO's comment that they are focusing on what their profits will look like. So, in my opinion, we are getting closer.

=]

G

Increasing mining costs and financial concerns to drive bullion, he says

Gold could "easily" rise to $2,200 an ounce in the next two years as costs increase and global financial concerns persist, said the chief executive officer of AngloGold Ashanti Ltd., the third-largest producer of the metal.

"It costs almost $1,200 to produce an ounce of gold," Mark Cutifani said at a conference in Perth. "The gold price probably reflects the fundamentals of the industry."

Read more here

Friday, October 21, 2011

Another believer in Gold Junior Miners—Edward Karr Interview

Truly after my own heart

=]

G

excerpts reposted from The Gold Report interview:

The Gold Report: RAMPartners is based in Geneva, Switzerland, a country that made economic news a month ago when the Swiss National Bank capped the Swiss franc at 1.20 francs per euro, slashed interest rates and flooded the market with Swiss francs. Did you agree with those moves and what impact do you think they had on the gold price?

Edward Karr: I emphatically disagree with the move by the Swiss National Bank. To me it makes no sense to peg the Swiss franc at 1.20 to the euro. Switzerland is, in effect, backstopping Greece and all of the other indebted countries in Europe. This is lunacy. Greece or anyone can just hit the Swiss National Bank's bid at 1.20 and convert into Swiss francs, which it would probably rather have than its euro position.

Since this policy, we've seen a psychological shift in markets. People have been rethinking the Swiss franc as a safe-haven currency. The Norwegian kroner looks more like a safe-haven currency now than the Swiss franc. I'm just happy Switzerland is not part of the European Union and not part of the euro. I hope it will understand the foolishness of the 1.20 peg and get rid of it soon.

As to the current effect on the gold price, right around when this happened gold topped and started to sell off. I don't think they are directly related, but I think it is psychological. If the Swiss franc holds at 1.20 to the euro, if a hedge fund or a corporation hits the Swiss National Bank with a billion euros, it is no big deal. But what about 10 billion, 100 billion, even a trillion? Then it starts becoming a big deal. At some point does Switzerland have to start selling its gold reserves to continue this lunacy? Switzerland now has 1,146 tons of gold. Maybe people are worried that if that gold starts to come out it could put downward pressure on the bullion price; hence, we have seen a little sell off in the overall market.

...

TRG: Gold has fallen steadily since reaching about $1,900/ounce (oz.) in August. It now sits at about $1,670/oz. Why has it fallen recently?

EK: I think the logical explanation for falling prices is that gold is a relatively liquid asset. Governments, hedge fund managers, bankers and individuals are all facing a severe cash crisis. In that environment you have forced liquidations. Governments are doing all they can to put a positive spin on a terrible environment. But, if you're a global macro hedge fund manager who has heavy redemptions, you have to sell your liquid assets to raise cash.

Man Investments is one of the biggest hedge fund groups. Last month it announced record redemptions of $7 billion. The firm has to raise cash, so what is it going to do? There are no bids out there for Greek debt, no bids for mortgage-backed securities, no bids for countless other OTC financial derivatives. Gold is liquid; it is easily tradable and has been part of the massive global scramble to cash that we've seen in the last two to three months.

TRG: How low could gold go?

EK: That's a great question. The only credible answer is that gold can go a lot lower than anyone expects. A lot of Johnny-come-latelies have bought into gold in the last few years. A big downdraft will shake out a lot of loose hands.

Europe is on the edge of a cliff. Dexia Bank might fall any day. UniCredit in Italy is right behind. I think we will see a severe domino effect that will make 2008 seem like a walk in the park. If Dexia or UniCredit or the European Central Bank itself had a big major gold position and it had forced liquidation, it will have to sell and the price could go down pretty dramatically.

...This party is just getting started. You can see the house, you can hear the music and see people, but you have not even walked in the front door. Wait for the party; don't leave before it even begins!

TRG: What are some rules of thumb for investing in junior resource companies during uncertain times?

EK: I like to own good companies with solid management teams and great assets. And then, it all comes down to the timing. The current markets are fantastic for finding attractive entry points. As a general rule, when it feels the worst is usually the best time to buy.

When people get scared, markets and stock prices get way out of line. That is when you need to have the courage to really step in and accumulate. Worst case, if the banks collapse and the ATMs actually do stop working, those who own physical gold will be better off than 99% of the other people out there. But it is more likely that the markets will rebound quickly as QE3 comes in and the ECB and the Fed turbo charge the printing presses. Then, the junior mining stocks and bullion will be off to the races.

TRG: What are some names you have positions in?

EK: I'm quite bullish on Sagebrush Gold Ltd. (SAGE:OTCBB), which trades on over the counter in the U.S. I like the company because it recently acquired a former producing gold mine and mill in Nevada. Nevada is a great jurisdiction; it has rule of law, most of the mines are easily accessible and it has the geology. It is the second most prolific gold zone in the world after the Witwatersrand of South Africa. Sagebrush bought the Relief Canyon mine and its brand-new $30 million (M), state-of-the art facility. It should start production by mid-2012. Relief Canyon currently has a 155 thousand ounce (Koz.) resource and it has an aggressive exploration program on the property right now.

...

TRG: Is Sagebrush looking to get listed on the TSX Venture or the TSX main board?

EK: I believe so. It is exploring both the TSX and the AMEX in the U.S. I would like to see the company listed on a more major exchange, where it will get increased visibility and liquidity, probably more research and publishing.

There is a further arbitrage opportunity here. Recently, Sagebrush acquired all of the assets of Continental Resources Group Inc. (CRGC:OTCBB). The deal was 0.8 shares of Sagebrush for every share of Continental. I believe the acquisition is still being worked out and the share swap will happen in the next few weeks. So the big opportunity is to buy the shares of Continental. Effectively, you are getting Sagebrush shares at around $0.31 with the current Continental price of $0.25. Sagebrush is in the $0.50 range, so this is like grabbing dollars for $0.60. Warren Buffet recently said he would buy Berkshire all day long for $0.90 on the dollar. By buying Continental, you get Sagebrush for $0.60 on the dollar. Plus Sagebrush acquired Continental’s portfolio of uranium exploration assets. Uranium is currently really beaten up post-Fukushima, but it is not going away longer term. I believe uranium prices will rally back when the cycle turns and patient investors will be well rewarded on this unique play.

Read full interview here

$10,000-$12,500 Gold—Caused by Fast Rising Money Supply?

G

US Money Supply Surges Surges 33% in 4 Months – Global Money Supply to Lead to Gold $10,000/oz?

excerpts:

U.S. M2 Money Supply: Accelerating Sharply in 2011

Demand from Asia is due primarily to concerns about fiat currencies – both domestic or local currencies but also the current reserve currencies of the euro and of course the global reserve currency, the dollar.

China M2 Money Supply: M2 Growth is Decelerating, Yet Still Rising

While all the focus has been on the Eurozone debt crisis recently, the US is suffering a stealth debt crisis of its own which is being ignored - for the moment. As is the burgeoning debt crisis in China.

The US fiscal position is appalling with a $1.6 trillion deficit projected for fiscal 2012 alone. For those who have lost count, the US national debt has risen to over $14.8 trillion. The latest updated projections reveal that the US will reach a 100 percent debt to GDP ratio by Halloween – in 10 days time.

Gold’s recent weakness has coincided with a period of dollar strength but with trade and budget account deficits as far as the eye can see, this dollar strength is likely to be brief.

Indeed, the dollar’s recent strength is due to the fact that while the dollar’s fundamentals are very poor – its competing fiat currencies such as sterling and the euro have similar if not worse outlooks due to imprudent monetary policies.

The possibility that gold could surge to as high as $10,000/oz is gaining traction amongst some respected market participants.

Paul Brodsky, co-founder of QB Asset Management Company has again warned regarding the risks posed to US Treasuries and the possibility of a sharp revaluation of gold that could see gold reach $10,000/oz.

A twenty-year veteran of the bond market in his own right, Brodsky told King World News that the US may return to some form of Gold Standard in order to restore faith in the US dollar.

Proponents, including Steve Forbes and Ron Paul, argue a gold standard would prevent what they see as irresponsible money creation and force the US to live within its means by limiting the amount of money monetary authorities can create.

The idea that the US could revalue gold and devalue the dollar (as was done by Roosevelt in the Great Depression) is gaining increasing currency.

Gold prices would hit $10,000 an ounce or even more should current calls for a return to the gold standard become reality, according to Brodsky.

In conversation with King World News, money manager, Stephen Leeb, said that gold is remarkably undervalued and “is going to add another digit over the next five to ten years there is very little doubt about that.”

Global Money Supply Chart

Leeb recently said that gold could rise to $12,500/oz...

Read more here...

Wednesday, October 19, 2011

"...personally I have sold gold to buy gold stocks and silver stocks..." Eric Sprott

From the video:

"... precious metals stocks are getting so cheap that they should out perform the metals here...we haven't see the earnings power of these companies...personally I have sold gold to buy gold stocks and silver stocks..."

Talks also about how silver is the real 'hidden' elephant of value.

It's your money (if you still have any)—Invest for the real and away from the unreal world manufactured by the banksters and sold like a ponzi-scheme to the rest of us while they take all the benefit. It's time stop buying the BS fr0m GS and 'friends'—LOL

G

Tuesday, October 18, 2011

The Buyers of Junior Gold Companies are Cashed Up and Ready to Buy

We are forming the fuel for a continuation of the gold bull market now. The next rise in Gold will be seen in the juniors IMO.

G

Repost from Barron's:

Gold Miners With Mother Lodes of Cash

Dundee Capital Markets offers up a list of gold-mining stocks that are generating lots of free cash flow.One of the golden rules of mining is to generate lots of cash and spend it wisely.

With volatility as the current theme in stock markets, we suspect investors are interested in seeking out stability in defensive names such as existing producers. This stability, we'd argue, can be achieved through established mines, which are already producing with little additional required capital expenditure to sustain or grow this rate of production.

Most would equate immediate safety with cash on hand today. But gold producers seem to always find a way to spend those hard-earned dollars on the latest exploration idea, recurring capital expenditures, not to mention those one-time acquisitions that CEOs can never seem to resist. So we've taken a look at each of the producers in our universe and estimated the free cash flow to have a look at who is generating the most, relative to their current market capitalization.

For an easy comparison across the space, we calculated the free cash flow yield, which takes 2012 estimated free cash flow per share divided by the current share price. Free cash flow yield demonstrates the cash generating abilities of the company relative to its share price.

While we recognize that this metric inherently disadvantages companies that are reinvesting cash flows to fund future growth (building and expanding mines), we also note that companies without major expenditures in the coming year are less likely to be exposed to significant financing risk.

Additionally, the analysis does not adjust for qualitative aspects of the individual companies including political, operational or currency risk which could impact these estimates.

From a defensive perspective, we believe relative safety lies in names with stabilized operations as opposed to those who expect to spend the next 12 months under construction or in commissioning.

Buy-rated companies we'd like to highlight include: Great Panther Silver (ticker: GPL), Osisko Mining, Aurizon Mines, and Kirkland Lake Gold [of Canada].

We would also highlight Aura Minerals [also of Canada], which despite its less defensive nature, offers significant torque on the upside should the company's plans materialize as expected.

Great Panther's strong free cash flow yield of 18% is largely due to recent share-price underperformance (as we have noted previously, the company's shares are strongly levered to the price of silver, not an overly advantageous situation of late), and our forecast of increased production from 1.6 million ounces of silver in 2011 to upward of 2.3 million ounces in 2012.

While declining silver prices have recently been the main driver of the share price, we note that recent financial results have been impacted by a temporary increase in onsite metal inventory.

With Osisko Mining's flagship Canadian Malartic mine commencing production in the second-quarter of 2011 and the only remaining major capital expenditure at Canadian Malartic being the additional pregrinding circuit (estimated at $32 million), we estimate that the company will generate free cash flows in the order of about $510 million dollars in 2012.

One could make the argument that Aurizon Mines is a victim of a market overreaction to some less-than-positive news. While the delay of the Joanna feasibility study does impact our valuation of the company, we consider the 22% decline (over the last three weeks) to be overdone -- in our opinion, more has come out of the stock than Joanna ever put in.

Friday, October 14, 2011

Silver Price Rise in Context

The Truly Remarkable Run of Silver

Thursday, April 21, 2011 at 03:23PM

As gold continues to receive all the headlines, silver continues to look at the yellow metal in the rearview mirror.

Below we highlight a few charts and tables that show just how remarkable the run for silver has been. Had you invested $100 in silver ten years ago today, your investment would now be worth $1,037. A $100 investment in gold would be worth about half that at $569, and a $100 investment in the stock market (S&P 500) would be worth -- wait for it -- $107.48.

The two main silver ETFs (SLV and DBS) have gone absolutely parabolic over the past few weeks. Both are currently trading more than two standard deviations above their 50-day moving averages, and just when they seem about as overbought as they can possibly get, they get even more overbought.

From Bespoke Investment Group

Read full article here.

Gold to Top $2,000 on Central Bank Buying

This article points out who the prime bull drivers for gold prices for the near term. Interesting to note that the potential for another gold-price correction may be driven but institutions rather than retail buyers as they try and plan their position in the new economy—whatever that may be.

G

Gold to Top $2,000 on Central Bank Buying: Chart of the Day

Published in Market Updates Precious Metals Update on 14 October 2011

Gold is trading at USD 1,675.30, EUR 1,214.20, GBP 1,062.30, JPY 129,036.00, AUD 1,634.90 and CHF 1,503.70 per ounce.

Gold’s London AM fix this morning was USD 1,676.00, GBP 1,062.31 and EUR 1,214.31 per ounce.

Yesterday’s AM fix was USD 1,673.00, GBP 1,065.74 and EUR 1,218.05 per ounce.

Gold is marginally higher in most currencies today and continues to consolidate at the upper end of the range between $1,600 and $1,700/oz. Physical demand for coins and bars remains very strong with GoldCore experiencing a notable increase in demand this week.

Gold is up nearly 3% on the week and looks set to post its biggest weekly gain in more than a month. Markets remain nervous about the risk of contagion ahead of a G20 meeting whose agenda will be dominated by the euro zone debt crisis and steps to tackle the contagion.

Gold should be supported by global inflation data this morning which remains stubbornly high particularly in emerging markets.

Inflation in China and India remains very high. In India, inflation exceeded 9% for the 10th month in a row and in China inflation is at 6.1% but the key food component of inflation rose 13.4% year-on-year in September.

European inflation accelerated the fastest in almost three years in September on soaring energy costs, complicating the European Central Bank’s task as it combats the region’s sovereign-debt crisis. The euro-area inflation rate jumped to 3 percent last month from 2.5 percent in August. Inflation in Germany also surprised to the upside this week.

The Bloomberg ‘Chart of the Day’ shows the proportion of gold in the international reserves of India, Russia, China and Mexico is significantly lower than the rates in the U.S., Germany and France, based on data compiled from the World Gold Council. The lower panel tracks central bank holdings in metric tons and the bullion price since March 2008.

Central banks last year were net gold purchasers for the first time in two decades.

“I certainly expect international central bank gold buying to continue, especially in emerging economies where foreign reserves are growing,” said Gavin Wendt, founder and senior analyst at Sydney-based Mine Life, which publishes reports on the metals industry. “It’s the safest option for them.”

Return to Gold Standard—Gold Would Hit $10,000!

Return to Gold Standard? Why Price Would hit $10,000

Source:CNBC

By: John Melloy

Executive Producer, Fast Money & Strategy Session

All the major countries in the world are in a race to debase their currencies in order to restart their economies. Either economic growth returns or—as some doomsayers predict—the 40-year run of fiat currencies ends.

And if under this worst case scenario the solution was to return to the gold standard of the Nixon years, the price of bullion would be worth $10,000-plus, six-times the current price, according to Paul Brodsky, co-managing member of QB Asset Management company and a self-professed ‘Gold Bug.’

...Read more here...

Thursday, October 13, 2011

Central banks are buying gold now—should you?

The central banks (CB) are now "swapping Dollars for Gold"... I wonder why. Perhaps they are also afraid that they cannot 'invent' a new financial market in time?

G

CB’s Buying Here, Swapping Dollars For Gold

by Richard Russell

“The signs are growing. I can see the signs in the number of vagrants in La Jolla and south in Pacific Beach (California). As I drive by I see little clusters of men and women (mostly men) huddled in doorways or sitting in the bushes beside the roads. These are vagrants, always a sign of a severe recession. Men holding cardboard signs stand by the side of the road. The signs read, ‘Vet needs work’ or ‘Single mom needs food for her three children.’”

“Where do these people live? I wonder, where do they sleep? How do they have the energy to stand in the blaring sun all day with their cardboard signs? But they are the signs of hard times. I've seen them before -- in the 1930s. Today they are pushing shopping carts around the city, carts filled with junk -- old blankets, tin cans, old toys, anything, it seems to fill up their carts.

These are the remnants of society, the ‘leftovers.’ How do they survive? I keep wondering and it scares me. These are people who have lost everything and it is spreading. On Wall Street they're ‘taking it to the streets.’ But these people are being shoved into the streets and the alleys and the bushes of every town in the US.

And I think, ‘But why La Jolla?’ And the answer is that nobody ever froze to death in La Jolla. I've seen them weather the nights in NYC. Some sleep on top of the subway grills where warm air is pushed up from below. Some sleep on the steps of churches where the chances of being robbed are slim. Others sleep under slabs of cardboard, which are fashioned into little huts.

The signs of hard times are all about, but will it get harder? It all brings back bad memories of the 1930s. And to tell you the truth I'm scared.

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/10/13_Richard_Russell_-_CBs_Buying_Here,_Swapping_Dollars_For_Gold.html

Friday, October 7, 2011

Physical silver running out because it's too cheap

Prediction: Silver $150 in 18 months—George Maniere

George adds a bit of history in his article so make sure you click the link to read the whole article

Silver prices may rise to $150 in 18 months

By George ManiereAs I write, Silver prices are back above $40 an ounce and that may be giving you the urge to sell. I would advise that you don’t. This recovery is for real, and it has much further to go.

While I have a price target of $50.00 by years end, I anticipate silver prices will peak at $150 an ounce in 18 months.

Central banks around the world are pushing lax monetary policies and this leads me to conclude that prices for all commodities (gold and silver in particular) will rise.

We've already seen this happen with Gold hitting a record high $1,923.70 an ounce on Sept. 7 and when gold goes higher; its baby brother silver quickly follows.

That's reflected in something called the gold to silver ratio, which shows how many ounces of silver it takes to buy one ounce of gold. Traditionally, this ratio acts as a price barometer for the two precious metals. And if you look at it right now, it's easy to see that $150 silver isn't far off...

Read full article here

Silver Shorts Cut Their Positions 50% In One Week

On another related personal note: now is the time to shop for gold and silver miners but more on that in another post.

G

Source: seekingalpha.com

By Chris Mack

October 3, 2011

As we anticipated earlier this year, commercial shorts including JPM are finally within grasping reach of covering their positions and transitioning to net long. For more than a decade, the large commercial trading banks have been trapped with an enormous short position in silver as the price has risen from its lows near $3 to its May high of nearly $50. Most analysts expected the commercial shorts to be broken in a short squeeze, likely launching silver above $100. However, this short squeeze will not occur.

In September 2010 these traders began to aggressively cover their short positions. Since then, commercial net short positions in silver have been reduced from over 65,000 contracts to 24,262 as of September 27, 2011 - and falling from 40,708 just one week earlier.

The large September take down from the $40 price level to the $30 price level has completely wiped out the small leveraged speculators, which saw their net long positions crash from 18,170 the previous week to 8,837. Meanwhile, open interest is threatening to break below the 100,000 level - indicating that speculative money has abandoned silver and sentiment is extremely low amongst investors. The combinational one-two punch of the May takedown and September takedown served to transition contracts from speculators to the commercial shorts at a much lower average price than most analysts ever expected.

Read more here

Wednesday, October 5, 2011

How the recent gold-smackdown happened & 5 Gold Stock Targets

G

reposted from: thestreet.com

5 Ways to Play the Gold Miner Spread

BALTIMORE (Stockpickr) -- The old saying goes that "all that glitters isn't gold" -- but lately all that's gold hasn't glittered much either.Gold prices have made a reasonably strong run in 2011, spurred on by a combination of gold's attractive status as an "alternative currency" and investors' flight to quality from stocks. More recently, however, fear of equities has been the primary driver of appreciation in gold prices. That's something that's been evident from the lock-in-step ascent of both gold and treasuries -- two fundamentally disparate asset classes.

The Fed's Operation Twist smacked down gold prices by making treasuries the comparatively more attractive anti-stock trade, drying up demand for the metal. Now the big question is whether gold has run its course -- or whether investors have a major buying opportunity for the yellow stuff.

With equities still under pressure and the favorability of treasuries a temporary phenomenon, I think that the latter is more likely. Already, gold prices have been basing at a technical support level. A retest of highs is certainly plausible right now.

But that's only half of the story.

The other half is in the gold miners. Traditionally, gold miners have been the best way for stock investors to get exposure to gold price movement. Because gold miners earn more when gold prices are higher, it's a logical way to profit from gold price appreciation. But that relationship has broken down a bit lately.

As stocks got shellacked since the beginning of the summer, the market dragged down miners while gold prices rallied. The spread between those miners and spot gold prices is a major trading opportunity right now.

Read more here

Click here for 5 Gold Stock Targets

Choices choices: Invest in “Toxic Waste Treasuries” or Gold and Silver?

Let's weigh today's basics with Bob Chapman..

G

Bob Chapman

October 5, 2011

Why would, almost non-yielding Treasuries, be a safe haven, when the government is broke? We would guess that, when a US dollar collapse comes, that owners of such bonds, notes and bills would like to lose equally what everyone else holding these debt instruments loses. We call it a commitment to stupidity. Those that see the folly in such action switch their cash flow to commodities, gold and silver. From a rational point of view such a switch is logical. Needless to say, central bankers, government bureaucrats and politicians get upset when investors engage in such alternatives and proceed to manipulate markets to their own satisfaction to the detriment of the people. We have to wonder what is so attractive about owning debt that pays little or no interest? In order to avoid such a dilemma one must step out of the box and separate themselves from the investment sheeple.

Over the past three years the Federal Reserve has purchased $2.25 trillion of Treasuries, Agencies and mortgage bonds known as toxic waste. We have no idea what the cost of this debt was and what its current value is marked to market. All we know is the Fed has debt on its books of some $3 trillion that they admit to. The Fed operates in secret and when asked difficult questions about its operations it says it is a state secret. Fortunately the court system and Dodd-Frank have uncovered some of these secrets, like a few trillion here they forget to tell us about and $16.1 trillion there that they covered up. These monies, that the Fed created out of thin air, went to transnational conglomerates and the banking and financial sectors in the US, England and Europe. A tight elitist connected group, that for some reason the Fed didn’t want to tell us about. The Fed bailed out temporarily banking in the western world and is still brazenly doing so. The latest caper was a $500 billion swap to again bailout European banks. Of course, three other central banks were supposedly partners in this bailout. If you believe that we have a bridge you’d really be interested in for sale. These people in the Fed and within government are incapable of telling the truth. Yes, the Fed creates reserves, totally without collateralization by buying Treasuries and other securities. No, they are not printing paper money, but what they are doing is tantamount to that.

...

Read more...

Tuesday, October 4, 2011

Market shows a recession coming. Is this just a false signal?

G

Stock market signals on recession may be wrong: UBS

Reuters – Thu, 1 Sep, 2011

NEW YORK (Reuters) - The stock market has a poor record of predicting U.S. recessions and is likely sending false signals again, according UBS strategists, who expect the S&P 500 index to post double-digit gains by the end of 2011.Excluding the current downturn, the S&P 500 has shed more than 17 percent 14 times since the end of World War Two, but the economy only fell into recession on nine of those occasions, equity strategists of the Swiss bank wrote in a research note published Thursday.

"Put differently, the market predicted roughly a third more recessions than actually occurred," they wrote in the report, entitled "14 of the last 9."

...

Read full article here...

Smart Money Remains in Gold and Silver

I am looking for this move to be foretold by a rise in gold and silver producers.

G

The article:

Gold and Silver Speculators Exit Market as Smart Money Remains

By Jordan Roy-Byrne Oct 04, 2011 8:00 am

The recent carnage in equities and in Europe precipitated the selloff in precious metals which has caused all the remaining speculators to exit the market.

My firm uses a combination of sentiment analysis and technical analysis in market timing which often gets a bad name in the retail crowd, which tries to time the market. Meanwhile the smart money utilizes market timing to weigh risk and reward. It’s rather simple when you acquire the skills, and it helps you understand markets. Recently my firm had been quite bullish on precious metals but thought we were in a small corrective period. We were wrong, as the sector has suffered from Europe’s version of 2008. The good news is our market timing work leads us to believe that the worst is soon to be over and this is an opportunity on the long side for those who have a twelve month time horizon.

Below is the Commitment of Traders (COT) for gold (data is as of last Tuesday). The commercial short position has dropped nearly 50% in the last few months. The commercials (the smart money, the end users and producers) are positioned more bullish than any other time in the past two years. This is another way of saying the speculative long position is at a two year low. Meanwhile, open interest is 28% off its high and close to a two year low.

In silver, we see that the commercials are net short only 24K contracts. This is the lowest since December 2008. Open interest is 35% off its high and at its lowest point since the end of Summer 2009.

Read full article here...

Monday, October 3, 2011

Weekly Stock Market Report

DOW ($INDU)The closed up 141.90 @10913.38 below it's MA(200) @11984.95

S&P500 ($SPX)The S&P 500 closed down 5.01 @1131.42 under it's MA(200) @ 1280.12

Volatility Index ($VIX)The Volatility Index closed up 1.71 @42.96 over it's MA(200)@21.99

Baltic Dry Index ($BDI)The Baltic Dry Index, an index that measures shipping spot freight rates of various dry bulk cargoes closed down 21 @1899.00 over it's MA(200) @1466.94

Gold ($GOLD)Gold closed down 35.50 @1626.50 for the week above it's MA(200) @1528.51

Silver ($SILVER)Silver closed down 1.10 @29.98 below it's MA(200) @36.06

U.S. Dollar ($USD)The U.S. Dollar closed up 0.05 @78.55 over it's MA(200) @76.37

Euro/U.S ($XEU) The Index closed down 1.03 @133.88 below it's MA(200) @ 140.27

Oil ($WTIC) OIL Light Crude closed down 0.95 @78.90 under it's MA(200) @ 95.26

From WakingTheBull.com's Weekly Report: Earnings, Economic Calendar

Sunday, October 2, 2011

Marc Faber: "Bigger Financial Crisis on the Way!

Thursday, September 29, 2011

Traders are teriffied!

Listen between the lines...

Monday, September 26, 2011

Faber: Gold Quite Oversold...Consider Buying Gold Over The Next Two Days

repost from Zero Hedge

Marc Faber: "Gold Is Quite Oversold. I Will Consider Buying Gold Over The Next Two Days"

Anyone trading gold and silver most likely had a heart attack this morning. Of that subset, anyone who survived and traded with conviction made a killing, following an impressive surge in both metals, which saw silver soar from $26 all the way back to $30, after it was made clear that there was no behind the scenes liquidation of the metal but merely more piggybacked margin hikes this time out of China as was first reported by Zero Hedge. Another factor that helped was Marc Faber's appearance on CNBC earlier, who said that gold is now "quite oversold" and that he would be adding to the yellow metal in the "next two days." In retrospect, he should have been adding today to his existing holdings. However, since he already has 25% in gold, he is forgiven. Mutual funds which, however, have about 1% in gold, are not.

Links

Read more and view video interview links here